ALERTS: THIS SITE IS UNDER CONSTRUCTION. PLEASE VISIT OUR CURRENT WEBSITE.

Fentanyl Resources | Community Health Assessment | Citizens Connect Crime Reports

Financial Transparency

Traditional Finances

Hays County is dedicated to serving its citizens in all areas of service, financial responsibility and transparency. Transparency provides citizens a window into government budgets and expenditures and is intended to provide the public with clear and searchable information regarding the county’s finances.

TexasTransparency.org is an additional resource available for citizens. This website contains information on local government finances in Texas, including the existing debt of cities, counties, schools and hospital districts and hundreds of special-purpose districts throughout the state.

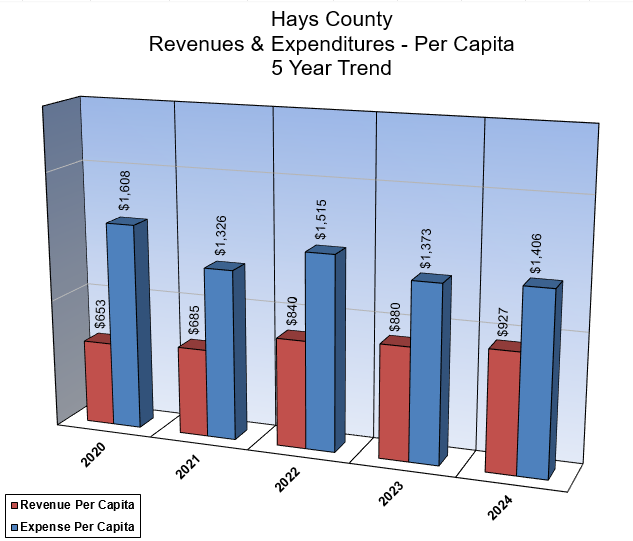

The information below includes revenues, expenditures, and debt per capita for the most recent adopted budget, Fiscal Year 2024 (10/01/23 – 09/30/24).

Fiscal Year – October 1 to September 30

FY 2024 Budget

| Hays County | Population | 266,255 |

|---|---|---|

| FY24 Budget | Per Capita | |

| Sales Tax Revenue | $34,060,000 | $128 |

| Property Tax Revenue | $131,961,103 | $496 |

| Total Revenue | $ 248,869,044 | $927 |

| Total Expenditures | $ 374,478,848 | $1,406 |

| Total Debt | $ 524,710,000 | $1,971 |

The chart below shows budgeted revenues and expenditures per capita for the period including fiscal years 2020 through 2024. Total expenditures include capital construction funds. Population data utilized was provided by the U.S. Census Bureau.

Hays County Budget

Basic transparency in financial planning is achieved through the annual budget process. Budget workshops open to the public are held during August to discuss the various departments’ needs for spending as constrained by the expected availability of budgeted revenues. A detailed, county-wide budget is subsequently adopted during a public hearing of the Commissioners Court in September.

Hays County Annual Budget Calendar

Hays County FY24 Raw Format Adopted Budget (link to Operating Budgets quick link, add excel file)

FY24 BUDGET HIGHLIGHTS

WHAT GOES HERE?

Hays County Fiscal Year 2024 budgeted revenue by function:

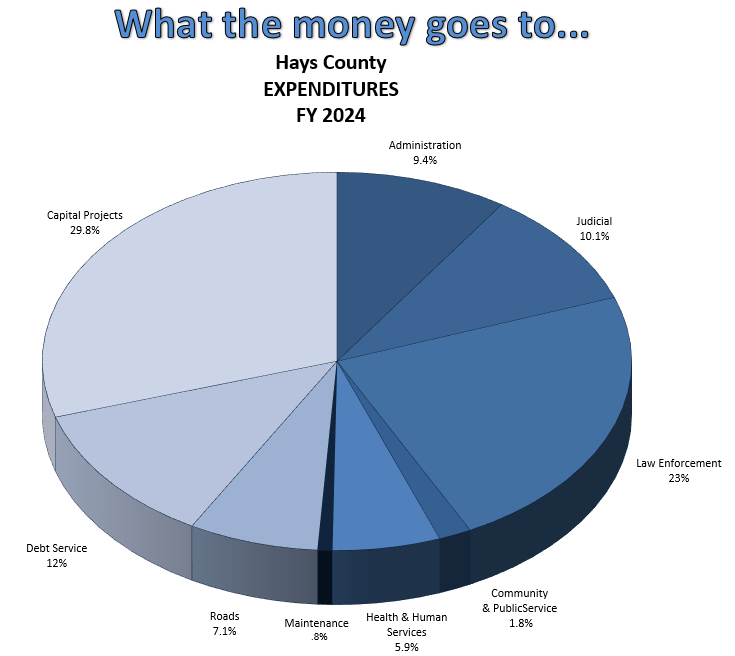

Hays County Fiscal Year 2024 budgeted expenditures by function:

Hays County topped the list as the fastest growing county in Texas and the U.S. among counties with populations of 100,000 or more, growing over 53% in the past decade. With this growth comes the need for additional infrastructure, law enforcement, and road improvements.

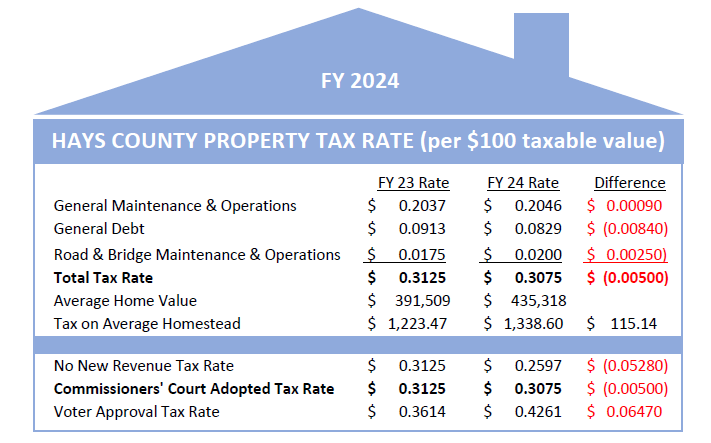

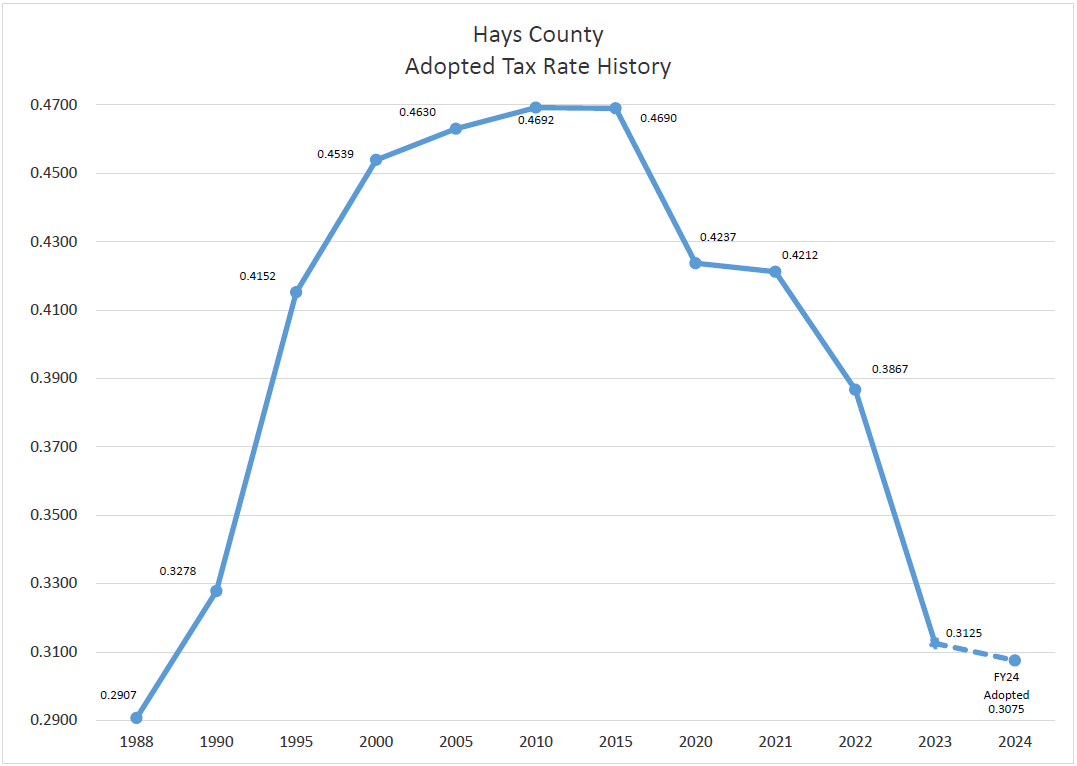

Property taxes are the primary source of revenue for counties in Texas, and our Commissioner’s Court is dedicated to maintaining a low county tax rate while providing superior services to the citizens of Hays County. This includes law enforcement to support public safety in communities and schools, effective regional transportation, parks and open space, support for the judicial system, reliable record keeping for deeds and public documents, elections administration, emergency planning, development, health and human services and much more. The level of service to meet this growth was accomplished while adopting the No New Revenue Rate (NNR) at .3075 cents, the lowest county tax rate since 1989.

Hays County Itemized Tax Rates

The Annual Comprehensive Financial Report (ACFR) is prepared annually to fulfill financial transparency, Texas statute, and Federal Single Audit Act requirements to have an annual audit of the county’s basic financial statements. The ACFR is prepared by the Hays County Auditor’s office presenting the county’s financial position with the requirements of the Governmental Accounting Standards Board.

The ACFR contains the opinion of an independent audit firm of Certified Public Accountants as to whether the financial data included therein presents fairly the financial position of the county. The Hays County Auditor’s Office ACFR has received the “Certificate of Achievement for Excellence in Financial Reporting” from the Governmental Finance Officers Association, the highest form of recognition in governmental accounting and financial reporting.

The Auditor’s “Certificate of Achievement” for the ACFR, for its fiscal year ended September 30, 2022, is the ninth consecutive such annual award. Striving to consistently present a transparent ACFR, the Auditor’s office expects to receive the Certificate of Achievement for the following years once submitted and reviewed by the GFOA.

County Debt Obligations

Click here to access the County Debt Transparency Page ???

County government expenses are generally funded from financial inflows received in the same fiscal year in which funds are used for the county’s expenses. An example is property taxes that serve as significant revenue inflows for the county that are used to meet operating expenses such as payroll expenses. In addition to operating expenses, the county funds long-term projects and improvements that cannot be readily funded using the current year’s financial resources. Examples of these projects and improvements include the construction of and improvements of county roads, park projects, and the construction or renovation of county facilities. To finance these projects, the county may issue long-term debt.

Although the County Commissioners Court has the authority to issue certain forms of long-term debt, other types must be approved by voters during a general election. To pay off the long-term debt issued over an extended period such as thirty years, a portion of the county’s annual property tax rate is restricted for the payment of the long-term debt. The county may also issue debt for the purpose of reducing future interest costs, also known as refunding debt. The Debt Information Summary includes the county’s total outstanding debt obligations, tax-supported debt obligations expressed total and per capita amounts and historical bond election information which includes date of election, purpose and amount.

Debt Information Summary (Add Document)

County Credit Rating

Hays County maintains an independent credit rating from recognized credit rating agencies that evaluate the county's financial strength and its ability to pay its existing bonds. The current credit rating for the county from S&P Global is AA+. Obligations rated AA+ by S&P Global are defined as very strong capacity to meet financial commitments. The recent Bond rating letter provides further explanation as to how the county achieved the AA+ rating.

County Bond Rating Letter (Add Document)

The graph below illustrates the county's total outstanding tax-supported debt for the last five fiscal years.

{Add Graph}

The graph below illustrates the county's inflation adjusted tax-supported debt per capita for the last five fiscal years. {Add graph}

For more information on county debt, please visit the

Texas State Comptroller of Public Accounts Debt at a Glance

website.

Right link?

For additional debt information provided by the state, please visit the Texas Bond Review Board website.

There are currently no known bond elections scheduled.

County Tax Rates (link to Tax Office)

HB 1378 Local Debt Report (Add Documents}

Time Trend (Add Documents)

Time Trends Adjusted for Inflation (Add Documents)

Debt Book (Add Documents)

Adopted Budget Debt Information

County Public Pension

Access the County Public Pensions Transparency Page - Right link??

Hays County offers its full-time employees’ retirement the state-wide Texas County and District Retirement System (TCDRS). TCDRS manages the county’s pension plan and is governed by the TCDRS Act of Texas. The county has decided to abide by the Act's rules regarding variable-rate plans. Every year, the employer contribution rate is calculated actuarially as a percentage of employee earnings, subject to plan modifications approved by the county’s governing body while adhering to Act-imposed restrictions.

| Personnel Information | |

|---|---|

| Employee Contribution Rate | 7% of salary |

| Employee Matching Rate | 225% |

| Years Required for Vesting | 8 Years of service |

| Service Retirement Eligibility | 75 years total (age + years of service); 30 years at any age |

Public Pension Summary (Add Document)

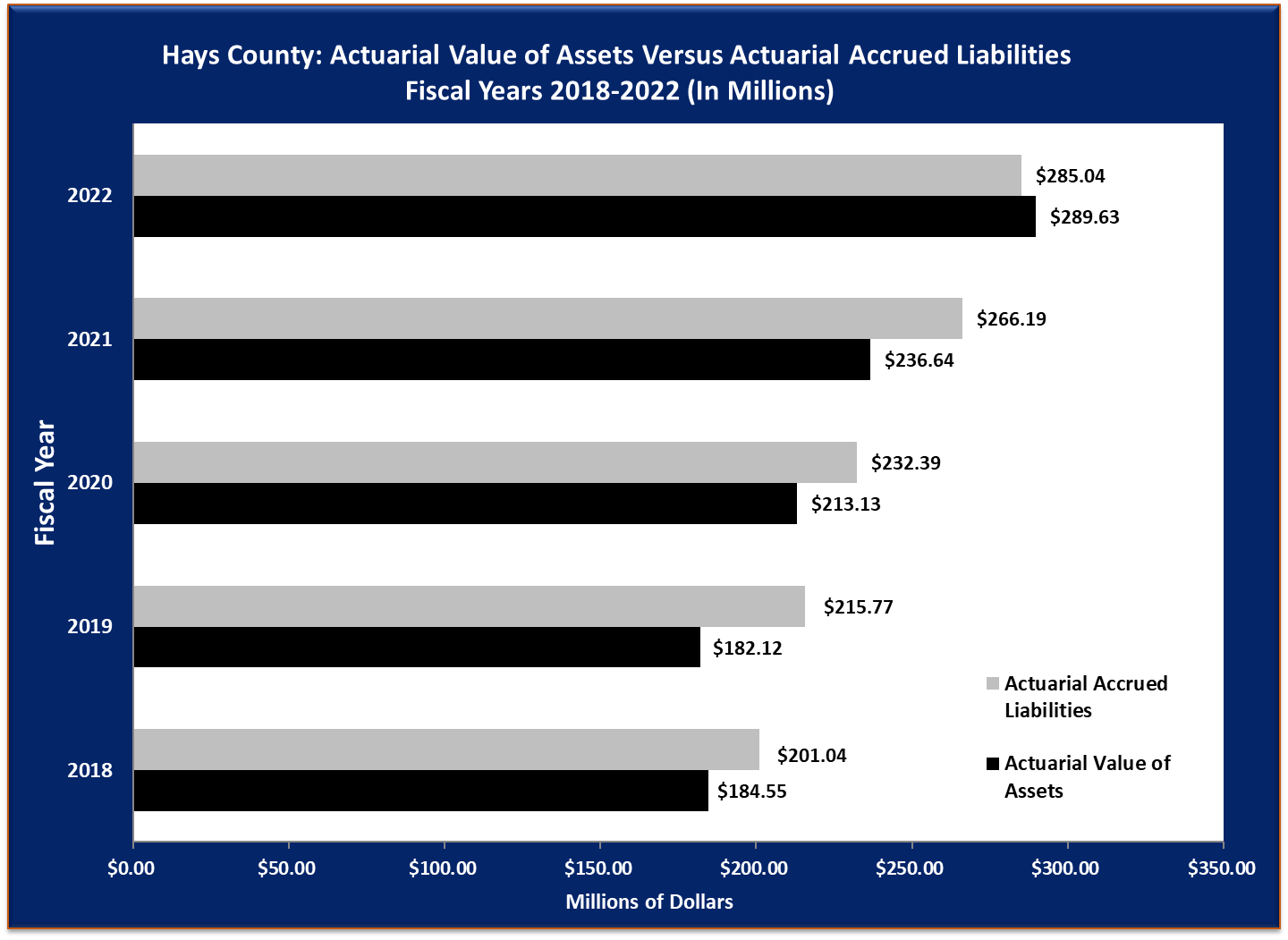

The chart below shows the actuarial value of assets versus the actuarial value of accrued liabilities for the period including fiscal years 2018 through 2022.

| Actuarial Information Milliman Actuarial Report January 1 to December 31, 2022 | |

|---|---|

| Actuarial Accrued Liability (AAL) | $314,374,309 |

| Actuarial Value of Assets (AVA) | $267,233,904 |

| Unfunded Actuarial Accrued Liability (UAAL) | $47,140,405 |

| Funded Ratio (AVA/AAL) | 85.0% |

| Remaining Amortization Period | 18.1 Years |

| Assumed Rate of Return | 7.5% |

| Pensionable Covered Payroll | $62,426,237 |

| UAAL as a Percent of Covered Payroll | 76% |

Public Pension Summary (Add Document)

The chart below shows the actuarial value of assets versus the actuarial value of accrued liabilities for the period including fiscal years 2018 through 2022.

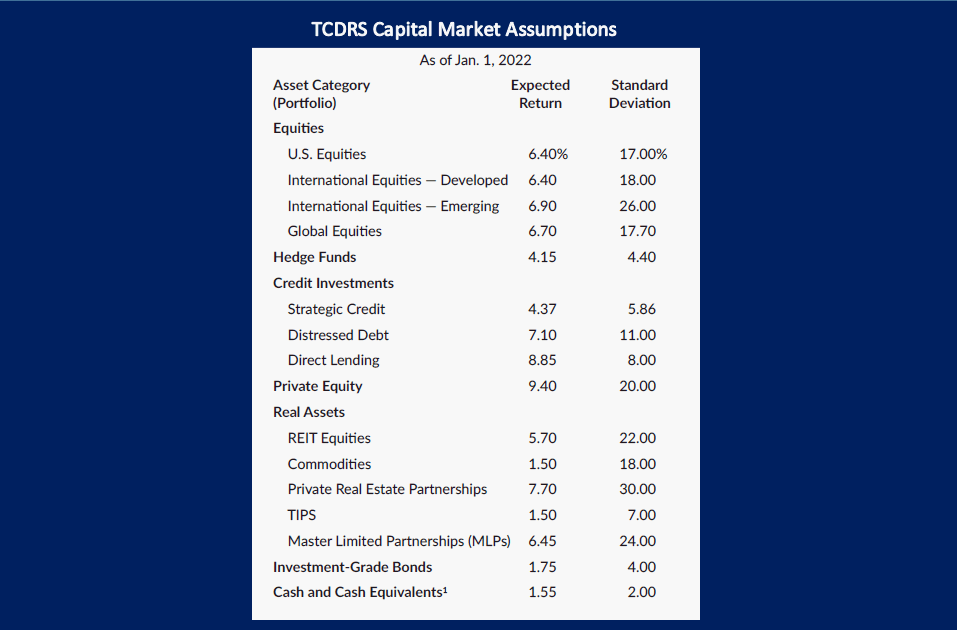

Best estimates of geometric real rates of return for each major asset class included in the TCDRS target asset allocation as of January 1, 2022 are summarized below:

For more information, visit the TCDRS website.

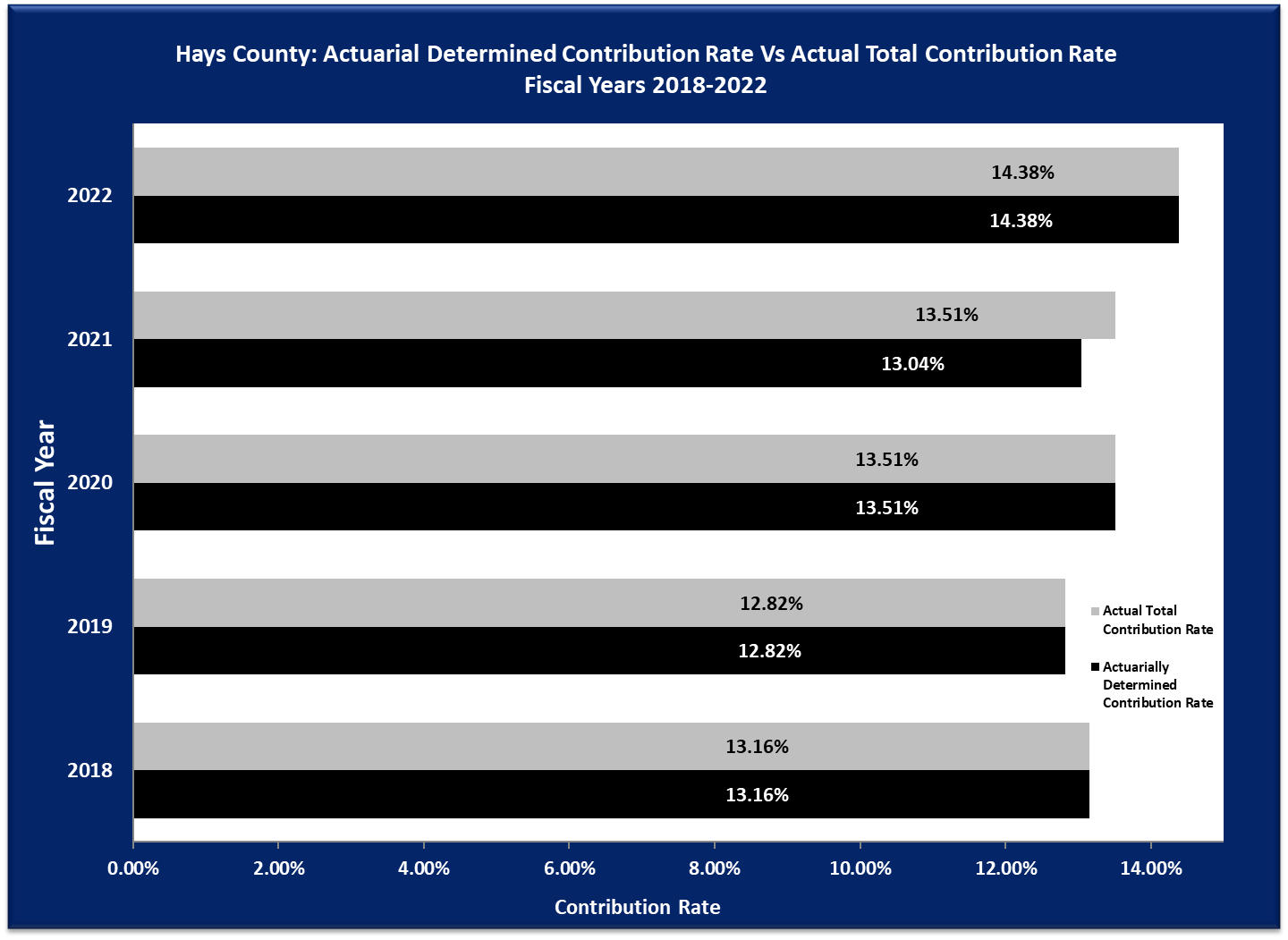

Contributions

| Actuarily Determined Contributions (as a % of salary) | |||||

|---|---|---|---|---|---|

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| Employee | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% |

| Employer | 14.38% | 13.51% | 13.51% | 12.82% | 13.16% |

| Total Required Contribution | 21.38% | 20.59% | 20.51% | 19.82% | 20.16% |

The chart below shows the actuarial determined contribution rate versus the county's actual contribution rate for the period including fiscal years 2018 through 2022. Download the contribution rates visualization.

For additional resources, visit the Texas Comptroller's 'Public Pension Search Tool' webpage.

Pension Related Documents & Data

FY2023 Actuarial Valuation (Document)

2022 TCDRS Annual Comprehensive Report (Document)

FY2022 Actuarial Valuation (Document)

2021 TCDRS Annual Comprehensive Report (Document)

FY2021 Actuarial Valuation (Document)

2020 TCDRS Annual Comprehensive Report (Document)

FY2020 Actuarial Valuation (Document)

2019 TCDRS Annual Comprehensive Report (Document)

FY2019 Actuarial Valuation (Document)

2018 TCDRS Comprehensive Annual Financial Report (Document)

FY2018 Actuarial Valuation (Document)

Data Set - Five Years of Additions and Deductions (Document)

Auditor’s Reports

| File Name | Download |

|---|

Tax Rate Information

2 FY 2024 Expenditures – Requested

4 FY 2024 Capital Equipment & Projects Requested

Auditor’s Reports

Debt

Texas Comptroller of Public Accounts - Texas Transparency

HB1378 – FY 2018 Local Debt Report

HB 1378 – FY 2019 Local Debt Report

HB 1378 – FY 2020 Local Debt Report

HB 1378 – FY 2021 Local Debt Report

Utility Usage

| File Name | Download |

|---|

Other Information

Other Links

Find it Fast

Quick Links

Hays County, Texas

Main County Mailbox:

712 S. Stagecoach Trail

San Marcos, Texas 78666

Main Number: 512-393-7779

Connect with us!

©Copyright 2023-24 Hays County, Texas | Website by Munission